Missing Middle Housing & Home Ownership

Over 90% of respondents in the 2021 Middle Housing Study conducted by the Utah Foundation identified housing affordability as their primary concern. Between 2010 and 2021, housing prices in Utah increased nearly 16%, with monthly mortgage costs increasing nearly 40%. The 2023 Guiding Our Growth survey conducted by the Utah Governor's Office of Planning and Budget identified similar concerns, and also highlighted both urban and rural Utahns' desire for more housing options, including Missing Middle Housing types.

For more and more Utahns, the prospect of home ownership becomes increasingly out of reach with every passing month. With housing costs continually rising and available housing stock not keeping pace with demand, it is more critical than ever before for communities to focus on finding solutions to address housing needs. Missing Middle Housing types like duplexes, cottage courts, triplexes, townhomes, and multiplexes offer more affordable options that can be more attainable for middle-income earners.

Below are basic descriptions of ownership options available in Missing Middle Housing product types, which can significantly increase homeownership opportunities, particularly for those who may not qualify for traditional single-family homes or subsidized housing. And when MMH options are added near activity nodes - where streets are well-connected, transportation choices are available, and various destinations are accessible - the combined burden of housing + transportation costs can be substantially reduced.

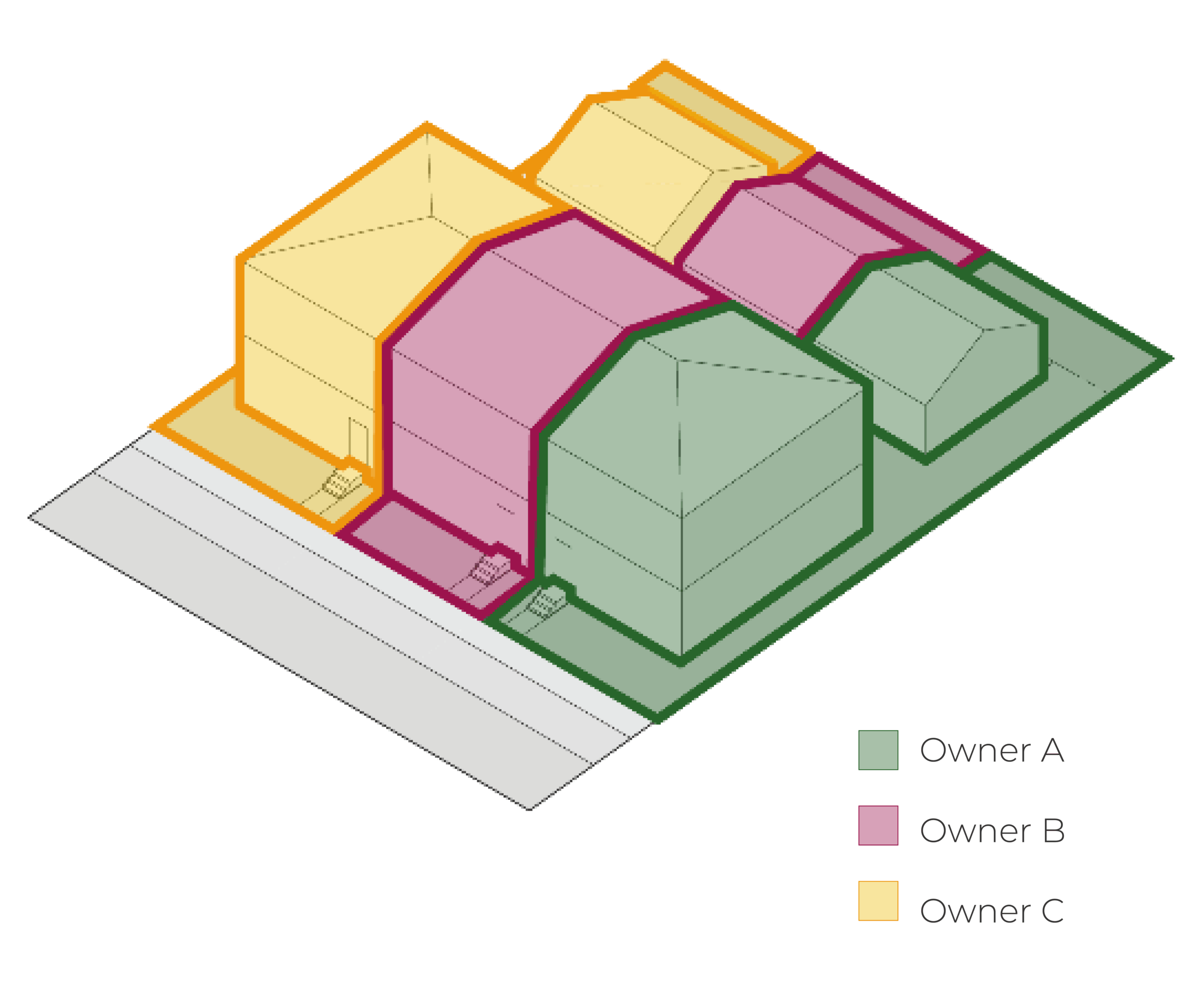

Fee Simple

Ownership

Owners own the units and the land under and around them. Units that are smaller than typical detached single-family homes provide housing options that are less expensive to purchase and maintain.

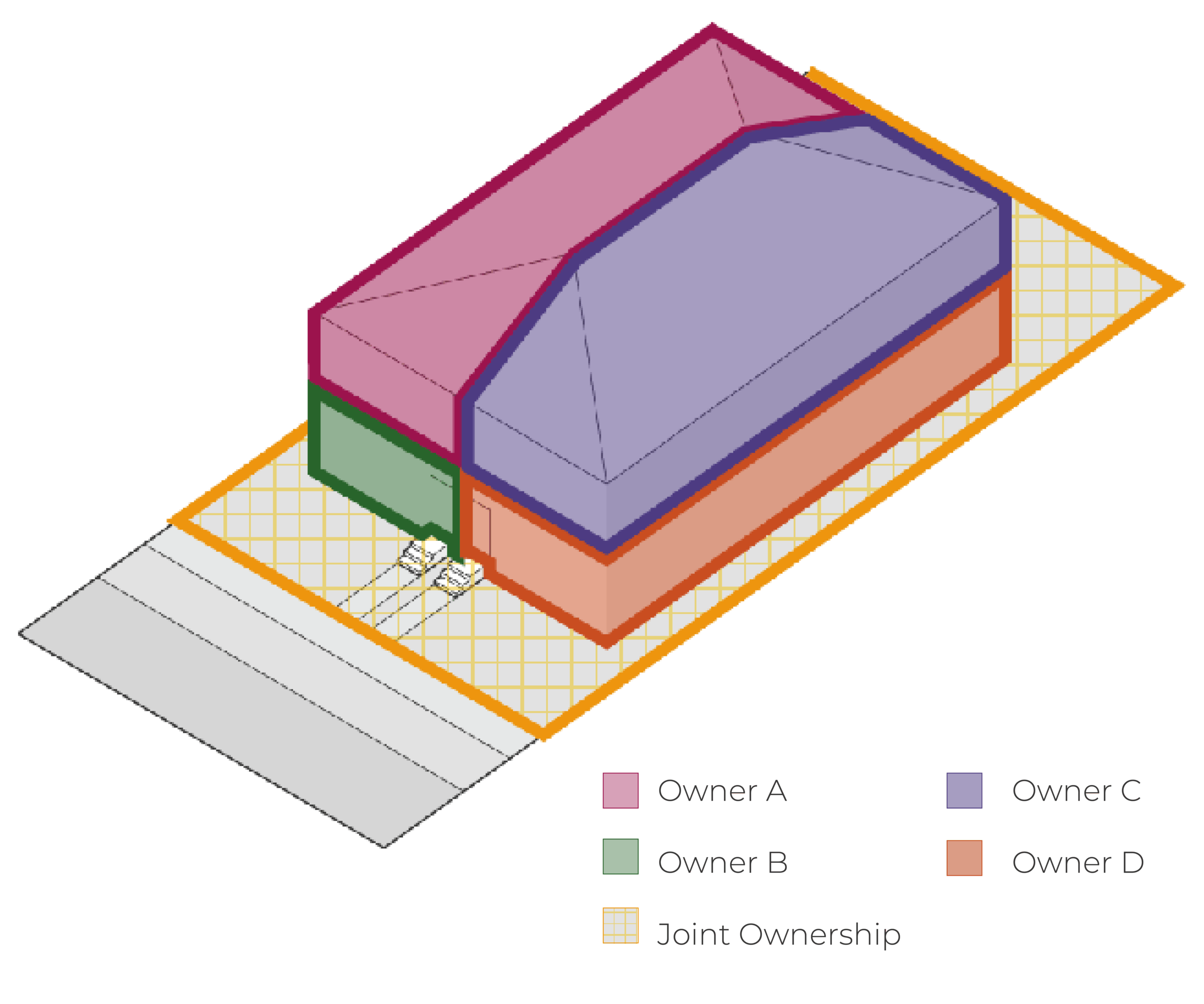

Condo

Ownership

Owners own the interior of their unit, while common areas are held in joint ownership through a condo association of which all owners are members. Distributing the cost of land can make units easier to afford.

Fee Simple

"House Hack"

Owner lives in one unit and rents out the other to help provide supplemental income to cover mortgage and maintenance costs. Income from rent helps bring homeownership within reach for those whose wages alone are not sufficient to buy a house.

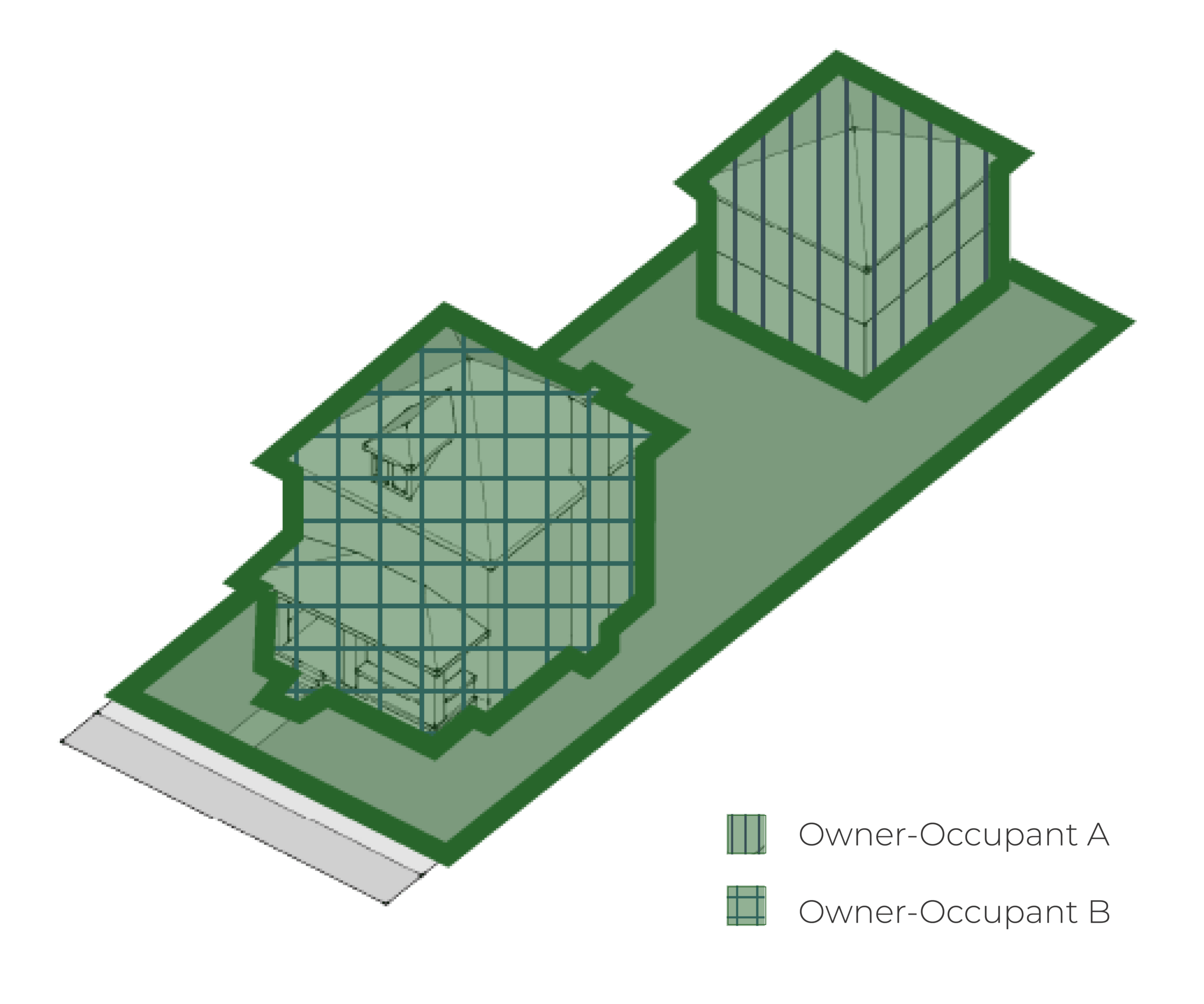

Multi-generational

Joint Equity

Ownership is shared according to the terms of a co-ownership agreement. As an example, children could “buy-in” to their parent’s equity, allowing them to build their own equity without the expense of buying their own home. Living spaces may be shared divided among separate units to allow for greater independence.